Newsletter commentary May 2023

Time:2023-06-03

Time:2023-06-03

The market in May remained very challenging, and investors’ confidence was even more fragile than in April. The market is full of various concerns about the Chinese economy. Our portfolio continues to be under significant pressure. However, we believe that the market may be overly pessimistic about the Chinese economy, and investors' views on Chinese stocks have implied too many negative expectations, which may have overlooked some important information. Our view is that for the Chinese economy to recover, it may only need some more time.

Investor’s expectations for the recovery of the Chinese economy will invisibly set an anchor for the recovery path. For instance, compared to the recovery of the US economy or to the Chinese economy in 2019. However, these preconceptions are distant from the path of Chinese economic recovery, and the interference of some compensatory consumption behavior on the road of recovery has made investors’ expectations even more confusing.

Given the data in January and February cheered everyone up, then raised expectations, but it was found that the interference of compensatory behavior was significant. Then the data fell back, which intensified concerns about the future.

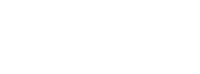

Then followed the withdrawal of fiscal stimulus policies since the beginning of this year. The adjustment of the auto subsidy policy at the end of last year, the release and decline of real estate demand, the inventory adjustment caused by fluctuations in entrepreneurial confidence, and the impact of base effects on high-frequency data have all exacerbated the volatility of economic data, which has affected sentiment.

Compared with the recovery of the US economy, the US has covered most of the difficulties on the road to recovery by printing money, leaving only one problem, which is inflation. Obviously, in China, we do not give money to households, so there is no comparability. Even though, compared with the Chinese economy in 2019, we speculate that the structure of Chinese economy has undergone significant distortion in the short term, and this may be one angle to explain the current contradictions.

The overall size of the Chinese economy has grown by approximately 10% compared to 2019 during the three years of the pandemic, but the internal structure has changed significantly. Real estate sales have declined by nearly 30%, leading to continued caution in construction and investment, and related industries have clearly shrunk. After 2019, due to the advantages of China’s supply chain and the promotion of short-board filling, there has been a lot of investment in the manufacturing industry, which has formed, industrial advantages and created huge production capacity. Before the pandemic, the service industry had already lost attention to the manufacturing industry, and during the pandemic, the service industry was hit hard. The balance sheets of many companies were severely affected, and many small and micro services industries closed. Even at present, many industries have not yet recovered to the level of 2019, such as tourism, international flights, sports, performances, education, and exhibitions, which are the key sectors of employment.

In summary, compared to 2019, the overall size of the Chinese economy has grown significantly, with the manufacturing industry showing significant growth. However, a portion of the real estate industry chain has declined, and many industries in the service sector are still far below the level of 2019.

Many current economic phenomena can be explained by the above analysis. China’s manufacturing industry has developed greatly and has become a powerful competitor in export markets. Its global trade share has increased substantially over the past three years and has been largely maintained after the pandemic.

The underperformance of the service industry has directly affected the job market, which in turn has affected the job market, which in turn has affected income expectations. This has made it difficult for the scenario to seamlessly connect to a stronger recovery under restored income expectations.

Moreover, the recovery of the service industry is beneficial to the improvement of the job market on a large scale, which can further promote the improvement of income expectations and ultimately drive the purchase of durable consumer goods, digesting the excess production capacity of the manufacturing industry. Otherwise, the manufacturing industry’s excess production capacity cannot experience a strong recovery.

Notably, CPI and PPI have dropped from around 2% to 1%, making it difficult for companies to make profits, challenging the confidence of entrepreneurs and investors.

As the decline in real estate sales has increased the pressure on local governments finances and raised concerns about local debt. Although local debt has been managed more effectively in recent years, concerns about local finances have not diminished.

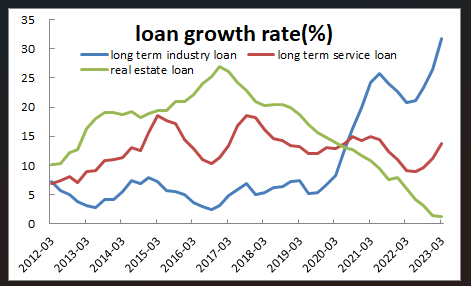

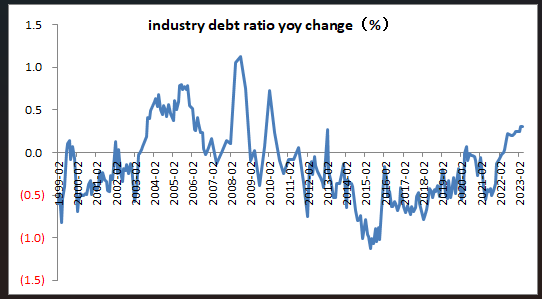

Contrary to the market’s concerns about balance sheet decline, we believe that we are still far from this scenario. The debt of corporate and household sectors continues to expand, and interest expenses have not become a serious problem as many people imagine.

Let’s first look at the situation of Chinese industrial enterprises. Compared with April 2018, the assets of industrial enterprises have increased by 47%, liabilities have increased by 45%, , but financial expenses have decreased by -7%. This is consistent with the continued pressure on the interest spread of listed banks and the difficulty of income growth. Currently, interest rates are at a historically low level.

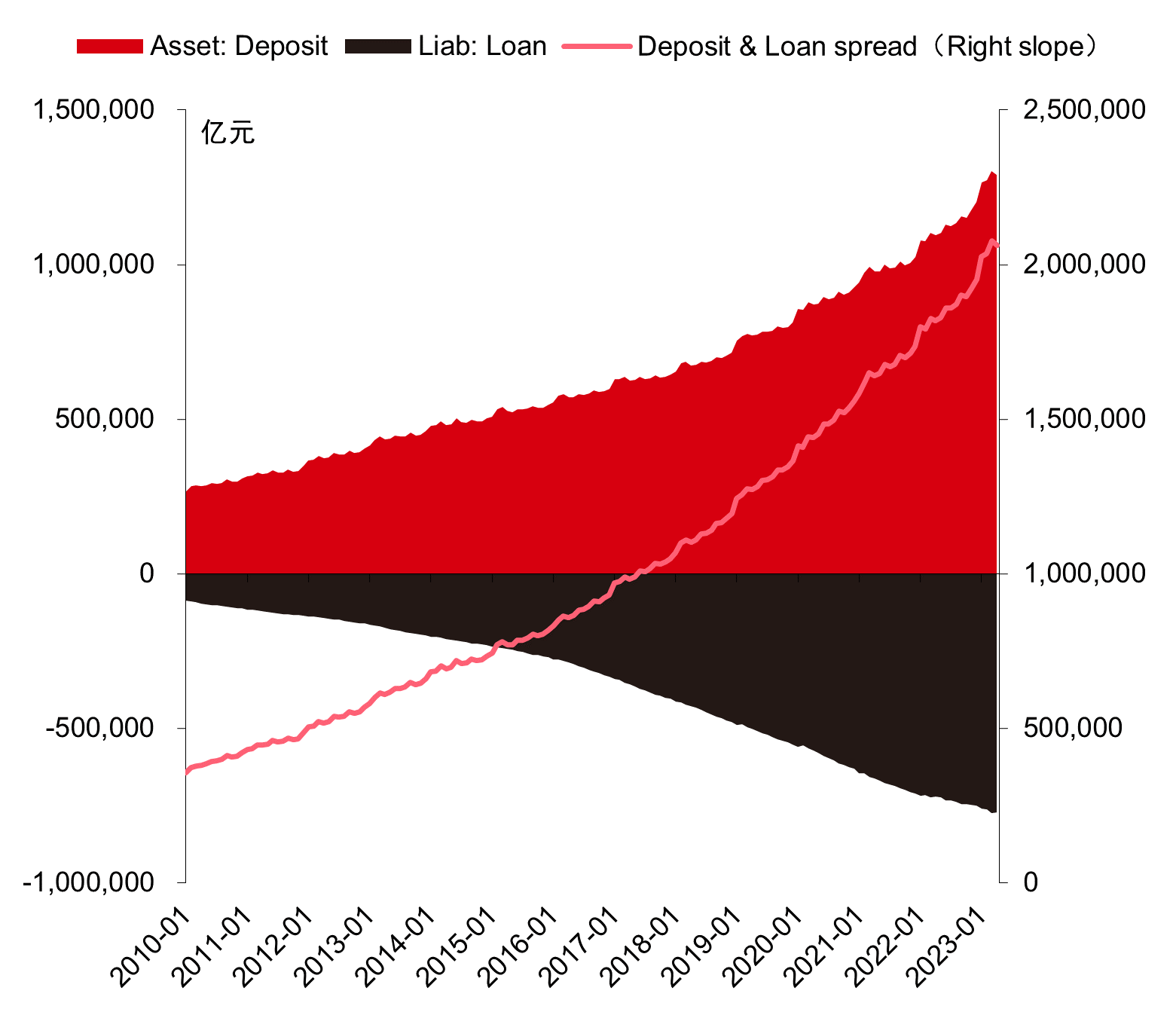

Looking at the household sector, the overall debt of households continues to grow, and the deposit and loan spread of the household sector is also increasing, with a slight acceleration during the pandemic. Considering that the loan interest rate adjustment for households may have a higher stickiness, and household come has also increased, we expect that the proportion of interest expense to income will not deteriorate significantly. However, the differences in population distribution have not been considered, and the situation of low-income groups and small and micro business owners may be more difficult.

Relevant policies can be implemented to help low-income groups and address the stickiness of household loan interest rates. However, overall, we believe that we are still far from the market’s concerns.

We estimate that the consumption rate before the pandemic was about 65-66%, and it has now dropped to around 61-62%. We do not expect households to start using the excess savings accumulated during the pandemic. Assume the consumption rate rises with the improvement of income expectations, it will have a huge boost to the economy.

Regarding local debt, the central government has been strengthening its management, and some replacements have been made in history. Overall, including implicit debts, the debt ratio is not high, especially the debt ratio of the central government. The overall credit spread of some non-standard local debts has not changed much after default. Therefore, bond market investors seem to remain calmer than stock market investors.

Compared with other countries, we have many supportive tools to facilitate, and avoiding systemic risk is not just a slogan. We have the ability and tools to do so, and it is more of problem of theoretical understanding and breakthroughs in practice innovation, such as how to balance “substitution work for aid” preventing moral risks in local government debt replacement, and meeting development needs.

Many approaches to resolving local government debt have used the equity value of state-owned listed companies (SOEs), which has become a successful practice in many provinces. This has indirectly promoted the realization of the equity value of these companies.

More importantly, the issue of local debt is a long-term problem, more related to the division of financial and administrative powers between the central and local governments are facing financial constraints, while the central government is relatively restrained in spending, the economy is still in the early stages of recovery, and if fiscal stimulus is withdrawn too quickly, local governments may face a funding shortfall, and income expectations of economic entities have not fully recovered yet, which can easily expose contradictions.

In the past, we were very cautious about inflation and had a lot of experience in dealing with it. Now, we see that both insufficient and excessive stimulus can have consequences. The US is currently experiencing inflation due to excessive stimulus, while we are facing insufficient demand. Historically, inflations were relatively easier to deal with because of our experience, but now, addressing insufficient requires time and innovation.

The current issue is more related to the slowdown in economic momentum, and one of the key issues is the short-term mismatch in the proportion of manufacturing and service industries. Supporting the recovery of the service industry and giving it time can solve many problems, accelerate the economic momentum, digest excess manufacturing capacity, improve profitability and confidence. Without support measures, the economy will gradually recover as the pandemic recedes, but at a slower pace. Some support measures can be more effective and faster, especially for low-income groups and small and micro-entrepreneurs. This will also help us achieve our long-term goals.

In terms of stocks, we have seen the following changes. Firstly, many Chinese internet service companies have greatly exceeded expectations in terms of performance, and most of them are reducing low-efficiency investments and increasing shareholder returns. Some companies have entered another phase of development, and the market has undervalued the value of reducing low-efficiency investments and increasing shareholder returns. Some companies are still running at high speed, making effective global investments, and the market has also undervalued the ambition of these companies.

Secondly, the rise of Japanese stocks, the sustained rise of US large technology company stocks, and the rise of Chinese tech and AI stocks may all indicate that investment is entering a new world where opportunities are scarce. On hand is grab cheap high-dividend stocks, and on the other hand is to actively pursue the next growth opportunity.

Third, the supply of China’s manufacturing industry needs additional demand to digest excess production capacity.

Overall, we believe that the Chinese economy’s recovery is still ongoing, albeit slowly, and may benefit from support for the service industry. Some positive changes have been overlooked by the market, such as the low inventory levels resulting from cautious expectations in the past few months.

In terms of capital and fund flows, the level of openness of the Chinese stock market has increased significantly compared to before and has been influenced by international capital flows like never before. Restoring confidence among international investors may be a slower process, as historically, this part of the capital has been mainly involved in long-term investments, and there is now a gap in this type of capital.

Risk appetite for domestic funds has also decreased significantly due to the difficulties in investing since 2021, and there are few funds continuously flowing in. The remaining funds are more active in trading, and the power of contrarian investment is weak. All of these are adaptive variables to the gradual improvement of economic data. We believe that the economy is improving, albeit slowly and not interrupted.